UX Research and Strategy

Parachute Health

Parachute Health is a health tech startup that provides an all-digital solution for ordering medical equipment and services for patients in need.

As the first UX Researcher, I was tasked with figuring out why users dropped off at certain sections in our platform.

Timeline

The Team

Research

Design

Product

Sales

7 Months

Tools

Methods

Generative interviews,

Affinity mapping,

Quantitative Metrics (NPS + SEQ)

Post-its,

Airtable,

SQL

THE CHALLENGE

UX PROCESS

Parachute Health had no established research protocol, so I was tasked with pioneering the first in-depth user research process and insights for product/design team. There was no budget and healthcare is a highly regulated industry, so I had to be creative with how to interview users.

Methodology

I conducted 30 in-person interviews to establish a holistic view into our users’ behaviors and motivations behind their interactions with our product.

Recruitment

I created a recruitment strategy using cold calls, CEO’s personal contacts and through sales representatives to approach our user base from many angles.

Strategy

I became more strategic about which users to interview based on time and resources, because I was a UX team of one and our team works in an Agile environment.

Synthesis

I worked with the Director of Design to synthesize the interview results and quantified the trends we were seeing.

Process Change

The designer and I created a Design/UX company update. From there, I advocated to incorporate research into the Agile environment on a more consistent basis and developed more UX Data (NPS, SEQ, user dropoff percentages).

PHASE ONE

DISCOVERY

APPROACH

Conduct 1:1 qualitative user interviews to determine trends in user issues.

Conduct variety of methods to reach out to users in person

Synthesize interviews with designer and quantify the trends through Airtable

Create company-wide update of top user pain points

Airtable Research Database where I housed all the data

INSIGHTS

USER-WISE

Users are frustrated that they’re not told that a supplier doesn’t take the insurance after an order has already been processed

Users having many supplier communication and delivery Issues

Users at large facilities have trouble following delivery messages due to order volume

I provided company-wide UX update based on insights I discovered so far

PROCESS-WISE

Traveling to different facility types is time-consuming and slow in Agile. I identified top 3 order-volume facilities to interview for most insights.

IMPACT

This was the first time quantifying user trends to help inform designs. Design/UX update was a success and internal members wanted to know more about users.

PHASE TWO

PROCESS CHANGE

I had a user research database, but we weren't using the feedback to drive product changes. Therefore, I iterated on ways to showcase and incorporate feedback for stakeholders.

APPROACH

Advocate for product process to communicate user issues to determine whether feedback is actionable

Visualize and quantify data more for internal stakeholder comprehension (Attempt 1, Attempt 2)

Curate insights specific for product team

Incorporate more product metrics for holistic UX picture

ITERATION 1

It was good to see high level problems but they weren’t digestable.

Insights

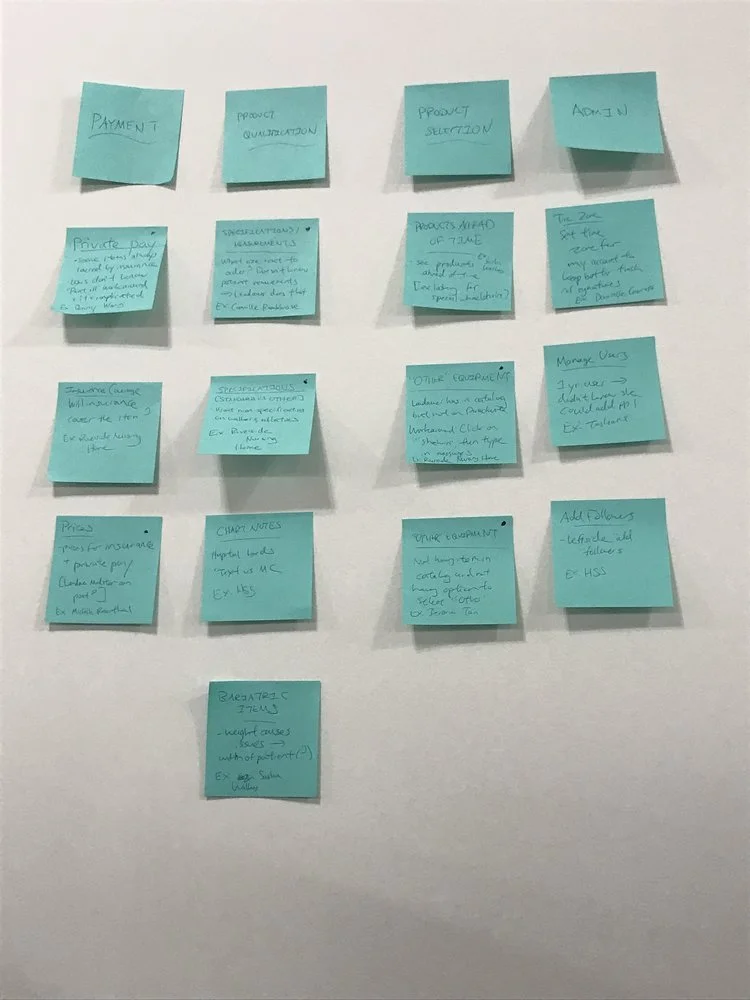

I created high level themes from the user feedback. Using Post-its, I made a visual accumulation to determine scope of issues and display individual quotes.

ITERATION 2

I created a simplified visual to communicate problems and created insights specific to the product team.

Insights for Product Team

If users can’t find the product and know the supplier carries it, users want option to add it

Various incorrect supplier deliveries and communication

Users want a clear way to select private pay

THE ANALYSIS

METRICS

Along with the synthesis of qualitative interviews, I was responsible for analyzing UX Survey to track NPS and SEQ.

QUOTES

“You can make the equipment that is being ordered easier to find”

“Unable to view products available unless order placed”

NPS

“How likely are you to recommend Parachute to a colleague?”

(UX Update to Company) : We’ve stayed consistent with our previous NPS score. Noted in the UX survey results are testimonials and improvement areas that could increase our NPS score.

USABILITY

“How easy or hard is it to place an order with Parachute?”

(UX Update to Company) : Overall, we have a good usability score indicating users like the site intuitiveness.

IMPACT

I created a process to incorporate user feedback into the Agile product process on a more consistent basis.

I also was able to create quantitative metrics to relay the customer experience to the company as a whole.

THE CONCLUSION

NEXT STEPS

Iterate on user pain point categorization and relay to internal teams (operations, sales)

Meet with product manager every week to analyze user feedback (Update: user dropoff research deprioritized due to business growing/scaling prioritization)

TAKEAWAYS

Not all insights are actionable

Communicating with the product manager, I understood from a business and development perspective what user insights take longer to incorporate into the product roadmap.

Reach out to other departments

Since I work with the product/design team, I thought relaying user issues to them was sufficient. I realized research was relevant to other departments and updated them consistently.

Delve deeper than NPS/SEQ

NPS and SEQ scores are useful for senior stakeholders to understand user satisfaction at a glance. However, NPS responses are vague, so user research follow-up is needed to understand the core problem.